Build-to-Rent: The hot trend in multifamily development

In recent years, build-to-rent real estate has become a popular strategy to help close a gap for rental housing in the US. As the demand for housing outpaces supply, many homebuilders and real estate developers have invested more capital in build-to-rent projects in hopes of benefitting from the trend.

What is build to rent (BTR) in real estate?

The build-to-rent business model is used by real estate developers or investors to build single family houses for rent instead of for sale. It reimagines the model of single-family residential living from a traditional, individually owned home to a long-term rental in a professionally managed community. Build-to-rent (BTR) is also known as build-for-rent (BFR).

Build-to-rent communities offer amenities similar to those of multifamily apartment complexes, such as a pool, club house, fitness center, and a leasing office. In suburban areas, build-to-rent communities can resemble a traditional single family housing development with an array of detached homes. In more urban geographies, the units may take the shape of townhomes or condos to align with the area’s population density.

Why build-to-rent is booming

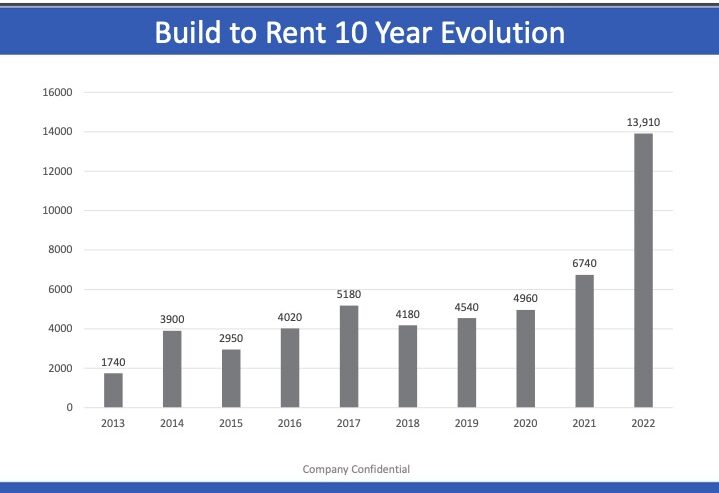

The BTR phenomenon may be the first true transformational change to the single-family home market in decades. A fairly new trend in residential real estate, the build-to-rent concept became popular in the aftermath of the 2008 housing market crash. It flourished from coast to coast, particularly in Arizona in the early 2010s.

Changes in renter preferences during the pandemic also fueled the BTR market. According to MRI Apartmentdata analysis, the urban core experienced occupancy decreases as high as 25% (Austin) while outer metro corridors saw record-breaking growth. With widespread adoption of hybrid or remote work arrangements, the need for space and privacy increased. Driven by increasingly high interest rates, uncertain economic conditions, and the lack of generously sized single-family lots in attractive areas, BTR makes the American Dream possible for millions.

Who lives in BTR multifamily developments?

Over the past decade, renting has become a more viable option for older and higher-income households (ages 35-64). In fact, total renter households increased by 4.1 million between 2010 and 2021.

Millennials (25 to 40 years old) now make up the largest group of consumers in the U.S. at 72.1 million people. There are only slightly fewer Baby Boomers (57 to 75 years old) at 71.6 million. Baby Boomers are selling their large homes to reduce costs and maintenance, and empty nesters are moving closer to their Millennial children and grandchildren. The data also shows that college students, pet owners, and seniors occupy new BTR spaces.

Today’s renters have outgrown apartment living. Higher incomes and a difficult buyer’s market mean renting is still the best option for many people. BTR multifamily communities will continue to be concentrated in high-growth areas that have thriving suburbs.

Cindi Reed, MRI ApartmentData

Build-to-rent market insights

According to MRI Apartmentdata, which currently tracks 19,000 BTR homes in 12 metros, the average size of a BTR community is 160 units. The largest BTR community is in Houston, with 809 units.

Some other noteworthy facts about the build-to-rent market include:

- 61% of BTRs are located in the suburbs. Land is king!

- School districts and land density influence location.

- Online searches for “Homes for Rent” tripled in 2021 compared to 2020 (Rentcafe.com)

Build-to-rent investment and financing activity

Investors

Investor response to build-to-rent has been favorable with fast lease-ups, longer lease terms, and strong rent growth. Per-unit pricing per square foot of BTR properties is consistent with Class A conventional apartments.

- Phoenix has the largest inventory of existing projects with a healthy development pipeline and will likely record the greatest transaction activity.

- Dallas/Fort Worth and Austin have the strongest BTR development pipelines and as these projects deliver, the sales activity should be robust.

Financing

Financing for single-family BTR is more attractive than portfolios of traditional single-family rentals:

- Debt Financing (Acquisitions) for BTRs on a single land parcel are often treated similarly to traditional apartment properties by Fannie Mae, Freddie Mac, FHA, Life Companies and bank lenders.

- Debt Financing (Construction) – Construction lenders have become comfortable with this asset class especially after seeing the lease velocity.

- Equity Financing – There has been a proliferation of institutional capital coming into this space as they have educated themselves on the asset class and are currently partnering with developers that can deliver a pipeline.

- Private-Equity & Partnerships – This is a primary funding mechanism for BTR operators. P. Morgan formed a $625 million venture with American Homes 4 Rent, while the Carlyle Group has teamed with Lafayette Real Estate.

- Home builders are partnering with operators: Taylor Morrison with Christopher Todd Communities and Toll Brothers with BB Living.

The outlook is outstanding for the build-to-rent asset class. With a robust investor appetite for these properties, we see the BTR trend staying hot – and filling a void in the current rental housing market.

Cindi Reed, MRI ApartmentData

Inform your property search with MRI ApartmentData tools

MRI ApartmentData is tracking the build-to-rent market so you can focus on the golden rule of real estate: location, location, location! MRI ApartmentData Competition Radar™ with Price Analyzer Plus is a cutting-edge analytical tool to report on the performance of floorplans. Use MRI ApartmentData tools to create a winning mix of units at your property. Research to determine the best mix of units and pricing for a new development can start with MRI ApartmentData.

Our Competition Radar with in-depth floorplan analysis compares similarly sized floorplans to a relevant, expanded group of nearby properties. The ability to review the different sizes and types of floor plans and the range of prices charged for each floor plan gives you the knowledge to determine the best mix of floorplans and prices accurately and efficiently for your project. The Competition Radar platform also includes revenue management and floorplan price guidance.

Get the multifamily data you need today

MRI ApartmentData offers subscriptions tailored for property management, investors/brokers, and on-site staff, including the ability to filter on the hot Built-to-Rent (BTR) market.

For more in-depth or specialized reports, we offer custom reports and sub-market subscriptions. Please contact us for more information about these products or any other service we offer.

Multifamily Industry Review: Leaving 2023 Behind and Discussing 2024 Trends

The economic fluctuations, slowing job growth, and surging supply that defined the multifamily market in 2023 are poised to prolong the pattern of market unpredictability that has become the new normal. As rent trends and job growth settle back into …